Let's dive right into it—Tesla stock price has been the talk of the town for years now, and for good reason. Whether you're a seasoned investor or just someone curious about the future of electric vehicles (EVs), Tesla is a name that's hard to ignore. With Elon Musk at the helm, Tesla continues to disrupt industries and push boundaries. But what exactly drives the stock price, and why should you care? Let’s unravel the mystery together.

Now, if you’ve ever wondered why Tesla's stock price seems to be on a rollercoaster ride, you’re not alone. The company has gone from being a niche EV manufacturer to one of the most valuable automakers in the world. But with every rise comes scrutiny, and Tesla hasn’t shied away from controversy. Whether it's Musk's tweets or production delays, the stock price often reflects the drama surrounding the company.

What makes Tesla stock so intriguing is its potential. It’s not just about cars; Tesla represents a shift towards sustainable energy, autonomous driving, and even space exploration. So, whether you're a fan of the brand or just a curious observer, understanding Tesla stock price is key to grasping the future of tech-driven industries. Let’s break it down, shall we?

Read also:Copa Catalunya The Ultimate Showdown In Footballs Heartland

Why Tesla Stock Price Matters

Tesla stock price isn’t just a number on a ticker; it’s a reflection of the company’s vision, innovation, and market sentiment. For investors, it’s a barometer of confidence in Tesla’s ability to deliver on its promises. But why does it matter so much? Let’s explore.

First off, Tesla isn’t your average automaker. It’s a tech company disguised as a car manufacturer, and that’s what sets it apart. The stock price reflects not just the sales of cars but also the potential of energy storage solutions, solar panels, and even its autonomous driving ambitions. Investors are betting on Tesla’s ability to dominate multiple markets, and the stock price is their way of showing faith in that vision.

Moreover, Tesla’s stock price has a ripple effect on the entire EV industry. When Tesla performs well, it boosts investor confidence in other EV companies too. Conversely, a dip in Tesla’s stock can send shockwaves through the market. It’s like the canary in the coal mine for the EV sector.

The Rise of Tesla: A Stock Market Phenomenon

Let’s rewind a bit and look at how Tesla stock price has evolved over the years. When Tesla first went public in 2010, its stock price was a modest $17 per share. Fast forward to 2023, and we’re talking about a stock that’s worth hundreds of dollars. That’s some serious growth!

- In 2013, Tesla reached a milestone by posting its first quarterly profit, sending the stock soaring.

- By 2020, Tesla’s stock price skyrocketed, partly due to its inclusion in the S&P 500 index.

- Even during the pandemic, Tesla managed to outperform expectations, proving its resilience.

What’s fascinating is how Tesla’s stock price has become a cultural phenomenon. It’s not just about the numbers; it’s about the story behind them. Elon Musk’s charisma, Tesla’s groundbreaking products, and the company’s commitment to sustainability have all contributed to its allure.

Key Drivers of Tesla Stock Price

Now that we’ve established why Tesla stock price matters, let’s talk about what drives it. There are several factors at play here, and understanding them can give you a clearer picture of the stock’s movements.

Read also:10 Great Movies To Stream While You Wait For Edgar Wrights The Running Man Remake

1. Elon Musk's Influence

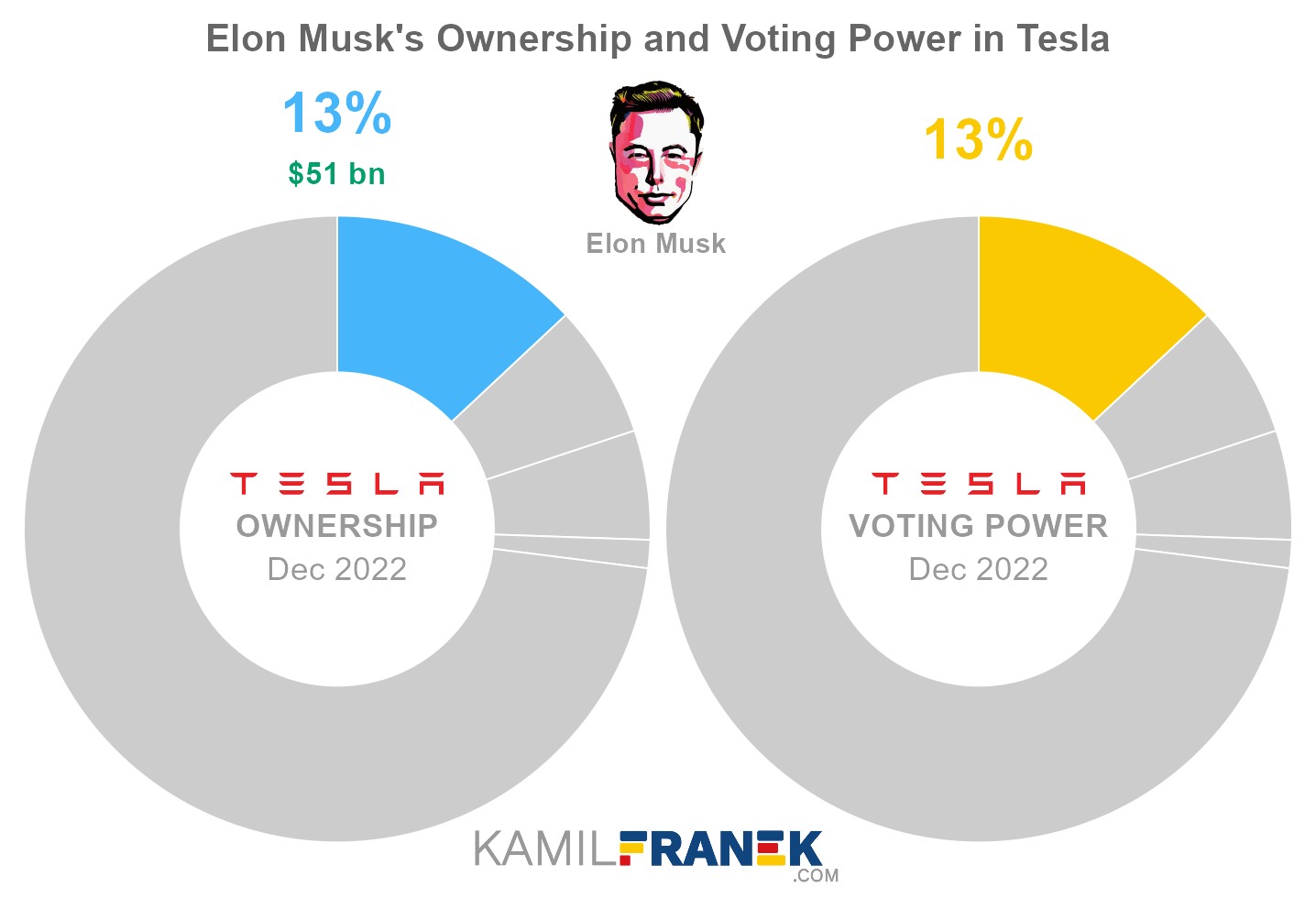

Love him or hate him, Elon Musk is a major player in Tesla’s stock price dynamics. His tweets, public appearances, and even personal life can have a significant impact on the stock. For instance, when Musk announced his plans to take Tesla private in 2018, the stock price fluctuated wildly. Similarly, his involvement in other ventures like SpaceX can influence investor sentiment.

2. Production and Delivery Numbers

Tesla’s quarterly production and delivery reports are closely watched by analysts and investors alike. These numbers provide insight into the company’s operational efficiency and market demand. A strong report can send the stock price soaring, while a weak one can lead to a downturn.

3. Regulatory and Environmental Factors

Tesla operates in an industry that’s heavily influenced by government policies and environmental regulations. Incentives for EV adoption, carbon credits, and trade policies can all impact Tesla’s bottom line and, consequently, its stock price.

Understanding Tesla's Financials

For investors, understanding Tesla’s financials is crucial to making informed decisions about its stock price. Let’s take a closer look at some key metrics.

Revenue Growth

Tesla’s revenue has been on an upward trajectory, driven by increasing sales of its vehicles and energy products. In recent quarters, the company has reported record-breaking revenue, which has boosted investor confidence.

Profit Margins

While Tesla’s revenue is impressive, its profit margins have been a point of contention. Critics argue that Tesla’s expenses, particularly in R&D, are high. However, supporters point out that these investments are necessary for long-term growth.

Tesla Stock Price Predictions

So, where is Tesla stock headed? Analysts and experts have differing opinions, but one thing is clear: Tesla’s future is full of potential. Here are some predictions to consider.

- Some analysts predict that Tesla’s stock price could reach $2,000 per share in the next few years if the company continues to innovate and expand.

- Others are more cautious, citing challenges such as competition from traditional automakers and potential regulatory hurdles.

What’s undeniable is that Tesla’s stock price will continue to be influenced by its ability to deliver on its ambitious goals. Whether it’s expanding into new markets or launching groundbreaking products, Tesla has no shortage of opportunities.

How to Invest in Tesla Stock

If you’re thinking about investing in Tesla stock, here are a few tips to keep in mind:

1. Do Your Research

Before buying Tesla stock, make sure you understand the company’s business model, financials, and competitive landscape. This will help you make an informed decision.

2. Consider Your Risk Tolerance

Tesla stock can be volatile, so it’s important to assess your risk tolerance. If you’re comfortable with fluctuations, Tesla might be a good fit for your portfolio.

3. Diversify Your Investments

While Tesla is an exciting investment opportunity, it’s always a good idea to diversify your portfolio. This can help mitigate risks and maximize returns.

Challenges Facing Tesla Stock Price

Of course, no investment is without its challenges, and Tesla is no exception. Here are some potential hurdles that could impact Tesla’s stock price:

1. Competition

As the EV market grows, so does the competition. Traditional automakers are ramping up their EV offerings, which could pose a threat to Tesla’s market share.

2. Supply Chain Issues

Tesla relies on a global supply chain for its components, and disruptions in this chain can affect production and, by extension, the stock price.

3. Economic Uncertainty

Economic factors such as inflation, interest rates, and geopolitical tensions can all impact Tesla’s stock price. Investors need to be aware of these macroeconomic factors when evaluating Tesla.

Conclusion: Is Tesla Stock Worth It?

In conclusion, Tesla stock price is a complex and fascinating subject. It’s driven by a combination of factors, including Elon Musk’s influence, production numbers, and market conditions. While there are risks involved, the potential rewards make Tesla an attractive investment for many.

So, is Tesla stock worth it? That depends on your investment goals and risk tolerance. If you’re looking for a company that’s shaping the future of transportation and energy, Tesla might be the right choice for you. But remember, always do your homework and consult with a financial advisor before making any investment decisions.

And hey, don’t forget to share your thoughts in the comments below. Are you bullish on Tesla, or do you think the stock is overhyped? Let’s start a conversation!

Table of Contents

- Why Tesla Stock Price Matters

- The Rise of Tesla: A Stock Market Phenomenon

- Key Drivers of Tesla Stock Price

- Understanding Tesla's Financials

- Tesla Stock Price Predictions

- How to Invest in Tesla Stock

- Challenges Facing Tesla Stock Price

- Conclusion: Is Tesla Stock Worth It?