Hey there, fellow finance enthusiasts! Ever wondered what makes the global financial markets tick? Well, let me tell ya, the FOMC is one of those behind-the-scenes forces that you absolutely need to know about. The Federal Open Market Committee, or FOMC for short, is like the captain of the ship when it comes to steering the U.S. economy. But what exactly is it, and why should you care? Let's dive in and find out!

Picture this: you're sitting at home, scrolling through your newsfeed, and suddenly you see headlines about interest rates going up or down. Ever thought about who decides that? Enter the FOMC. This committee plays a crucial role in determining monetary policy, which directly impacts everything from your mortgage rates to the value of your investments. So yeah, they’re kind of a big deal.

Now, if you're new to the world of finance, don't worry. We're about to break it all down in a way that even your grandma could understand. Stick around, because by the end of this article, you'll have a solid grasp on how the FOMC works, why it matters, and how it can affect your wallet. Let's get started!

Read also:Eric Church The Man Who Redefined Country Music

What Exactly is the FOMC?

Alright, let's start with the basics. The FOMC stands for the Federal Open Market Committee, and it’s essentially the decision-making body of the Federal Reserve System. Think of it as a group of financial wizards who meet regularly to decide on key monetary policies that influence the U.S. economy. These policies can have ripple effects across the globe, so their decisions are closely watched by investors, businesses, and governments alike.

Who Makes Up the FOMC?

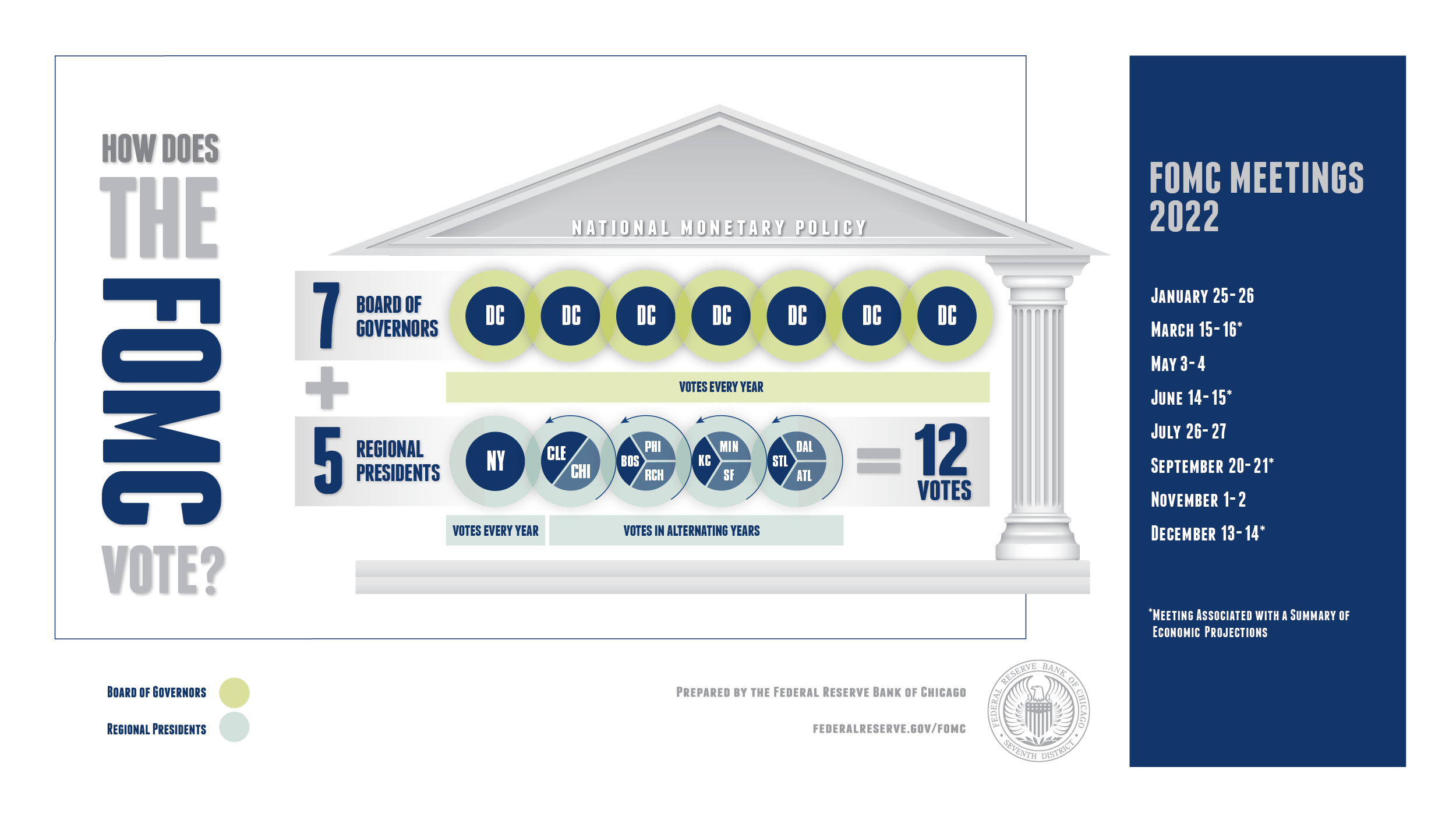

The FOMC consists of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Federal Reserve Bank presidents. The president of the Federal Reserve Bank of New York serves as a permanent voting member, while the other four spots rotate among the remaining Reserve Bank presidents. This setup ensures a diverse range of perspectives and expertise within the committee.

Here's a quick rundown of the key players:

- Board of Governors: The seven members appointed by the President and confirmed by the Senate.

- Federal Reserve Bank Presidents: The heads of the regional Federal Reserve Banks who bring local economic insights to the table.

How Does the FOMC Operate?

The FOMC holds eight regularly scheduled meetings per year, where they assess economic conditions and set monetary policy. During these meetings, committee members review data on employment, inflation, and economic growth to determine the appropriate course of action. They then vote on decisions such as adjusting the federal funds rate or engaging in open market operations.

Key Functions of the FOMC

So, what exactly does the FOMC do? Here are its primary functions:

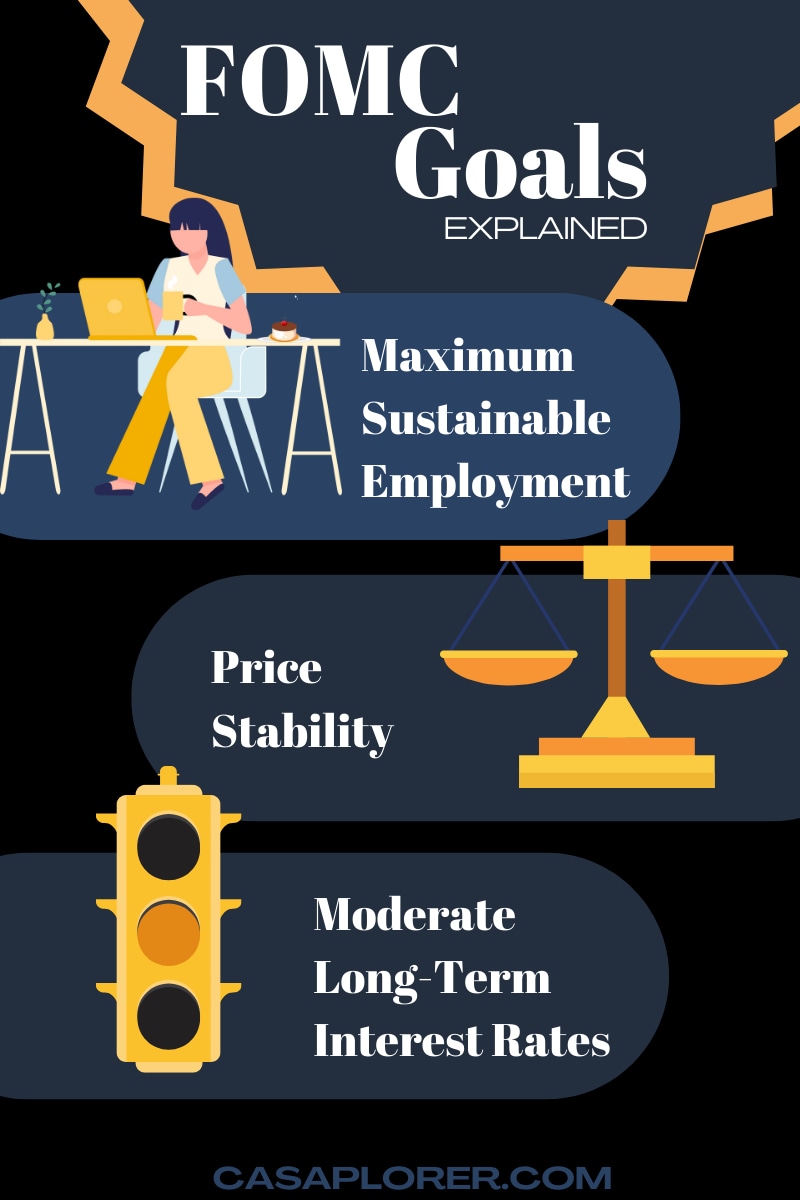

- Setting Monetary Policy: The FOMC decides on interest rates and other measures to influence the money supply and credit conditions.

- Open Market Operations: The committee buys and sells government securities to control the federal funds rate.

- Communicating Policy Decisions: After each meeting, the FOMC releases a statement outlining their decisions and reasoning, providing transparency to the public.

These actions might sound technical, but they have real-world implications for things like borrowing costs, consumer spending, and overall economic health.

Read also:Mike Fisher A Journey Of Passion Resilience And Success

The Impact of FOMC Decisions

Now that we know how the FOMC operates, let's talk about why their decisions matter. The policies set by the FOMC can have far-reaching effects on both the domestic and global economies. For instance, when the FOMC raises interest rates, it becomes more expensive for businesses and consumers to borrow money. This can slow down economic growth but also help control inflation.

Effects on the U.S. Economy

On a national level, the FOMC's decisions can influence:

- Inflation: By adjusting interest rates, the FOMC can help keep inflation in check, ensuring price stability.

- Employment: Monetary policy can impact job creation and unemployment rates, contributing to a healthier labor market.

- Housing Market: Changes in interest rates directly affect mortgage rates, influencing the housing market.

Global Implications

Internationally, the FOMC's actions can lead to currency fluctuations, impacting trade balances and investment flows. For example, when the U.S. dollar strengthens due to higher interest rates, it can make American goods more expensive abroad, affecting exports. Conversely, a weaker dollar can boost exports but may lead to higher import costs.

Understanding the Federal Funds Rate

One of the most important tools in the FOMC's arsenal is the federal funds rate. This is the interest rate at which banks lend reserve balances to other banks overnight. By setting a target range for the federal funds rate, the FOMC influences borrowing costs throughout the economy.

How the Federal Funds Rate Works

When the FOMC raises the federal funds rate, it becomes more expensive for banks to borrow money, which they then pass on to consumers and businesses in the form of higher interest rates. Conversely, lowering the rate makes borrowing cheaper, stimulating economic activity.

Here's a quick example: if you're thinking about buying a house, a lower federal funds rate could mean lower mortgage rates, making it easier for you to afford your dream home. On the flip side, higher rates might make you think twice before taking out that loan.

The Role of Inflation in FOMC Policy

Inflation is a key factor that the FOMC considers when setting monetary policy. The committee aims to maintain a target inflation rate of around 2%, believing this level promotes a stable and growing economy. However, if inflation rises too quickly, the FOMC may take action to cool it down, such as raising interest rates.

Measuring Inflation

To gauge inflation, the FOMC looks at various indicators, including the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index. These metrics help the committee understand how prices are changing across different sectors of the economy.

For instance, if the CPI shows a sharp increase in food and energy prices, the FOMC might decide to tighten monetary policy to prevent inflation from spiraling out of control.

FOMC Meetings: What Happens Behind Closed Doors?

While the FOMC meetings might seem like secretive affairs, they’re actually quite transparent. After each meeting, the committee releases a detailed statement explaining their decisions and the reasoning behind them. Additionally, the minutes of each meeting are published three weeks later, providing even more insight into the discussions.

Key Takeaways from FOMC Meetings

Investors and economists closely analyze the FOMC statements and minutes for clues about future policy moves. Here are some things to look out for:

- Forward Guidance: The FOMC often provides hints about upcoming interest rate changes, helping markets prepare for potential shifts.

- Economic Projections: The committee releases quarterly forecasts for GDP growth, unemployment, and inflation, offering a glimpse into their expectations for the economy.

Challenges Facing the FOMC

Like any powerful organization, the FOMC faces its share of challenges. One major issue is balancing the needs of different economic sectors. For example, a policy that benefits the housing market might not be as favorable for the manufacturing sector. Additionally, the FOMC must navigate global economic uncertainties, such as trade tensions or geopolitical conflicts, which can impact their decision-making.

Dealing with Economic Uncertainty

When faced with uncertain economic conditions, the FOMC often adopts a cautious approach, monitoring developments closely before making significant policy changes. This wait-and-see strategy allows them to gather more data and assess the potential impact of their decisions.

How Can You Stay Informed About FOMC Decisions?

Keeping up with FOMC decisions is crucial if you want to stay ahead in the world of finance. Fortunately, there are plenty of resources available to help you stay informed. You can follow official Federal Reserve announcements, subscribe to financial news outlets, or even listen to podcasts dedicated to monetary policy.

Tips for Following FOMC News

Here are some tips to help you stay in the loop:

- Sign Up for Alerts: Many financial websites offer email alerts for FOMC meeting announcements and statements.

- Follow Experts: Economists and analysts often provide insightful commentary on FOMC decisions, helping you better understand their implications.

Conclusion

And there you have it, folks! The FOMC is a vital player in the global financial landscape, wielding significant influence over economic conditions both at home and abroad. By understanding how the committee operates and the impact of its decisions, you can make more informed choices about your finances.

So, the next time you see headlines about the FOMC raising or lowering interest rates, you'll know exactly what it means and how it might affect you. Remember, knowledge is power, and staying informed is key to navigating the ever-changing world of finance.

Now, we’d love to hear from you! Have any questions about the FOMC or its role in the economy? Drop a comment below, and let’s keep the conversation going. And if you found this article helpful, don’t forget to share it with your friends and family. Until next time, stay sharp and keep those wallets fat!

Table of Contents

- What Exactly is the FOMC?

- Who Makes Up the FOMC?

- How Does the FOMC Operate?

- The Impact of FOMC Decisions

- Understanding the Federal Funds Rate

- The Role of Inflation in FOMC Policy

- FOMC Meetings: What Happens Behind Closed Doors?

- Challenges Facing the FOMC

- How Can You Stay Informed About FOMC Decisions?

- Conclusion