Let's cut straight to the chase, folks. If you're asking "how much is Tesla stock," you're clearly curious about one of the most talked-about companies in the world right now. Tesla isn't just a car company anymore—it's a symbol of innovation, sustainability, and bold ambition. Whether you're an investor looking to jump on the bandwagon or simply someone intrigued by the electric vehicle revolution, understanding Tesla's stock price is crucial. So, buckle up (pun intended) because we're about to take a wild ride through the world of Tesla's market value.

Now, before we dive into the nitty-gritty details, let's set the stage. Tesla stock has been on a rollercoaster journey since its IPO in 2010. Back then, it was trading at a modest $17 per share. Fast forward to today, and we're talking about a completely different beast. The stock price has skyrocketed, making Tesla one of the most valuable companies in the world. But here's the kicker: it's not just about the price—it's about what that price represents.

So, whether you're a rookie investor or a seasoned pro, this article will break down everything you need to know about Tesla stock. We'll cover the current price, historical trends, factors influencing the stock, and even some insider tips on whether it's worth adding to your portfolio. Trust me, by the end of this, you'll have a clearer picture of what you're getting into.

Read also:Trutv Your Ultimate Destination For Reallife Stories And Excitement

Table of Contents

- Current Price of Tesla Stock

- Historical Trends of Tesla Stock

- Factors Influencing Tesla Stock Price

- Investor Sentiment and Market Perception

- Tesla's Financial Performance

- Future Prospects for Tesla Stock

- Risks and Challenges for Tesla Investors

- Long-Term View on Tesla Stock

- Comparing Tesla Stock with Other EV Companies

- Final Thoughts on Tesla Stock

Current Price of Tesla Stock

Alright, let's get to the heart of the matter. As of the latest trading day, Tesla's stock price is hovering around $250 per share. But hey, don't quote me on that because the stock market is as unpredictable as a toddler on a sugar rush. Prices can fluctuate wildly based on news, earnings reports, and even Elon Musk's tweets. Yes, you heard that right—Elon's social media activity can send ripples through the market. So, if you're planning to invest, keep an eye on his feed, but don't let it rule your decisions entirely.

What Drives the Price?

There are several factors driving Tesla's stock price. For starters, the company's dominance in the electric vehicle (EV) market plays a huge role. Tesla isn't just selling cars; it's selling a vision of the future. Investors love that kind of narrative. Additionally, Tesla's expansion into renewable energy solutions like solar panels and energy storage systems adds another layer of appeal. Oh, and let's not forget the Gigafactories popping up all over the globe. These production hubs are key to scaling operations and driving profitability.

Historical Trends of Tesla Stock

Now, let's rewind the clock and take a look at Tesla's historical trends. When Tesla first went public in 2010, skeptics were lining up to bet against it. "Electric cars will never catch on," they said. Well, fast forward to today, and Tesla's stock has proven them all wrong. In the early days, the stock price was relatively stable, but as Tesla began to deliver on its promises, things started heating up.

- In 2013, Tesla's stock price surged after the company reported its first quarterly profit.

- By 2017, Tesla had become the most valuable car company in the U.S., surpassing giants like Ford and General Motors.

- 2020 was a game-changer. Tesla's stock price skyrocketed by over 700%, making it one of the best-performing stocks of the year.

Of course, there have been bumps along the road. Tesla has faced production challenges, regulatory hurdles, and even short sellers betting against its success. But through it all, the company has managed to keep moving forward, much to the delight of its shareholders.

Factors Influencing Tesla Stock Price

So, what exactly influences Tesla's stock price? Let's break it down:

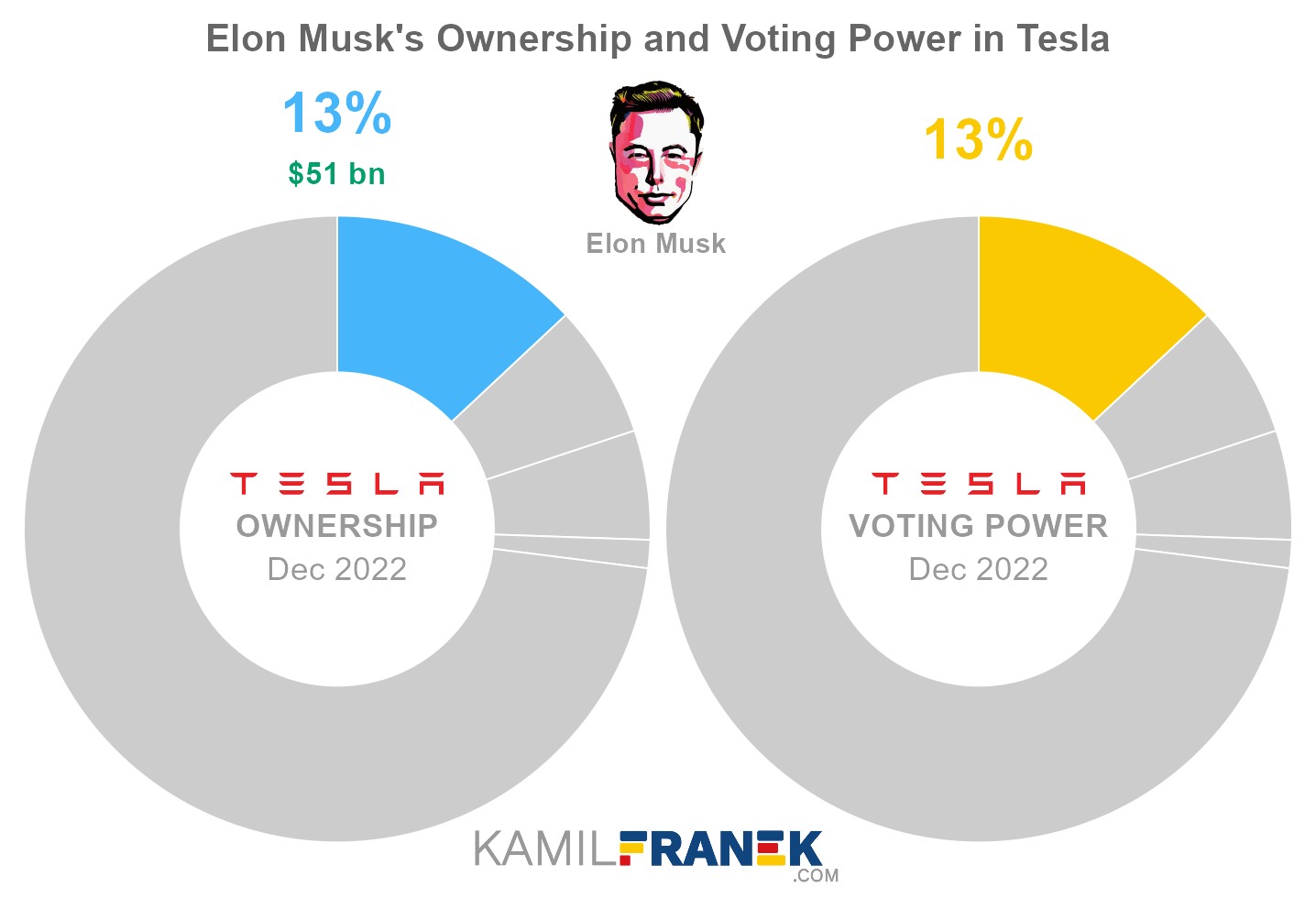

1. Elon Musk's Leadership

Love him or hate him, Elon Musk is the face of Tesla. His leadership style, vision, and occasional controversies all play a role in shaping the company's stock price. When Elon announces a new product or project, investors tend to get excited. On the flip side, when he makes controversial statements, the market can react negatively. It's a double-edged sword, but one that Tesla has learned to wield effectively.

Read also:Carrie Underwood The Queen Of Country Music And Beyond

2. Global Demand for EVs

As more countries commit to reducing carbon emissions, the demand for electric vehicles is only going to grow. Tesla is at the forefront of this movement, and that gives it a significant edge in the market. Governments around the world are offering incentives for EV adoption, which further boosts Tesla's prospects.

3. Technological Innovation

Tesla isn't just about selling cars. It's about pushing the boundaries of what's possible. From autonomous driving technology to advanced battery solutions, Tesla is constantly innovating. This focus on cutting-edge technology keeps investors interested and drives the stock price higher.

Investor Sentiment and Market Perception

Investor sentiment plays a huge role in Tesla's stock price. When investors are optimistic about the company's future, the stock tends to perform well. Conversely, when doubts creep in, the price can take a hit. Right now, sentiment is largely positive, thanks to Tesla's strong financial performance and ambitious growth plans.

However, there are still skeptics who question whether Tesla can maintain its dominance in the long run. The EV market is becoming increasingly competitive, with traditional automakers and new entrants vying for a piece of the pie. Tesla will need to continue innovating and expanding to stay ahead of the curve.

Tesla's Financial Performance

Let's talk numbers. Tesla's financial performance has been nothing short of impressive in recent years. The company has consistently reported record-breaking revenue and profits, thanks to strong sales of its vehicles and energy products. Here are some key highlights:

- In Q2 2023, Tesla reported revenue of $24.9 billion, up 57% from the previous year.

- Net income for the quarter was $2.3 billion, reflecting the company's growing profitability.

- Tesla's gross margin remains healthy, thanks to cost reductions in production and economies of scale.

These numbers are music to investors' ears, and they're a big reason why Tesla's stock price continues to climb. But as with any investment, it's important to look beyond the headlines and dig into the details. Is Tesla's growth sustainable? Can it continue to deliver strong financial results in the years to come?

Future Prospects for Tesla Stock

The future looks bright for Tesla stock, but there are challenges ahead. The company has ambitious plans to expand its production capacity, launch new products, and enter new markets. If it can execute on these plans, the stock price could soar even higher. However, there are risks to consider as well.

Upcoming Projects

Tesla has several exciting projects in the pipeline, including the Cybertruck, the Semi truck, and the next-generation Roadster. These vehicles have the potential to disrupt their respective markets and drive additional revenue streams for the company. Additionally, Tesla is investing heavily in battery technology, which could give it a competitive advantage in the long run.

Risks and Challenges for Tesla Investors

While Tesla's future looks promising, there are risks that investors need to be aware of:

- Competition: The EV market is becoming increasingly crowded, with new players entering the space every day.

- Regulatory Challenges: Tesla operates in a highly regulated industry, and changes in government policy could impact its business.

- Supply Chain Issues: The global supply chain remains fragile, and disruptions could affect Tesla's production and profitability.

Investors need to weigh these risks against the potential rewards before making any investment decisions.

Long-Term View on Tesla Stock

From a long-term perspective, Tesla stock looks like a solid investment. The company is well-positioned to benefit from the growing demand for EVs and renewable energy solutions. Its strong financial performance, innovative products, and global presence all point to a bright future. However, as with any investment, there are no guarantees.

For those with a long-term mindset, Tesla stock could be a great addition to their portfolio. But for short-term traders, the volatility of the stock could make it a risky bet. As always, do your research and invest wisely.

Comparing Tesla Stock with Other EV Companies

Tesla isn't the only game in town when it comes to EVs. Companies like Rivian, Lucid Motors, and even traditional automakers like Ford and GM are making waves in the industry. So, how does Tesla stack up against the competition?

While these companies have their strengths, Tesla remains the leader in terms of market share, brand recognition, and technological innovation. Its first-mover advantage and strong financial position give it a significant edge. However, investors should keep an eye on the competition, as the landscape is constantly evolving.

Final Thoughts on Tesla Stock

In conclusion, Tesla stock is a fascinating case study in modern investing. It represents much more than just a company—it's a symbol of the future of transportation and energy. The stock price has been on a wild ride, but the fundamentals remain strong. If you're considering investing in Tesla, make sure you understand the risks and rewards involved.

So, how much is Tesla stock? The answer depends on a variety of factors, including market conditions, company performance, and investor sentiment. But one thing is certain: Tesla is here to stay, and its stock will continue to be a topic of conversation for years to come.

Before you go, I'd love to hear your thoughts. Are you a Tesla bull or bear? Do you think the stock is overvalued, or is it worth the risk? Leave a comment below and let's keep the conversation going. And don't forget to share this article with your friends and fellow investors. Knowledge is power, and the more we share, the better off we all are.