Listen up, folks! The clock is ticking, and you might be sitting on some cold hard cash from Uncle Sam. That’s right; the deadline for claiming your $1,400 stimulus check from 2021 is rapidly approaching. If you missed out on this financial boost back in the day, now’s your chance to grab it—but only if you act fast.

Let’s break it down real quick. In 2021, the U.S. government rolled out another round of stimulus checks as part of the American Rescue Plan Act. This was aimed at helping people weather the storm of the pandemic by putting money directly into their pockets. But here’s the kicker—not everyone who qualified actually received their checks. And if you’re one of those folks, time is running out to claim what’s rightfully yours.

Now, before we dive deeper into the nitty-gritty details, let me ask you something. Are you someone who didn’t file taxes in 2020 or 2021? Maybe you didn’t think you qualified because you weren’t working or earning much? Well, guess what? You could still be eligible for that sweet $1,400 stimulus check. So, buckle up, because we’re about to unravel everything you need to know to get your hands on that dough.

Read also:Loss To Magic Shows How Important One Player Might Be To The Cavsrsquo Championship Hopes

What You Need to Know About the $1,400 Stimulus Check

First things first, let’s clear up any confusion around this whole stimulus check business. The $1,400 payment wasn’t just handed out randomly—it was based on specific eligibility criteria. If you meet those requirements, then congratulations, you’ve got a shot at getting this cash infusion. Here’s a quick rundown:

- Income Limits: Single filers earning up to $75,000 annually were eligible for the full amount. Heads of households with incomes up to $112,500 also qualified, while married couples filing jointly could earn up to $150,000 and still snag the full payout.

- Dependents: One of the coolest parts of this round of stimulus checks was that dependents—regardless of age—were included. That means if you had kids, elderly parents, or even adult dependents, they counted toward your total payment.

- Non-Filers: Even if you didn’t file taxes, you might still be eligible if you received Social Security benefits, Supplemental Security Income (SSI), or Veterans Affairs benefits.

So, if you fit into any of these categories and didn’t receive your check, don’t panic just yet. There’s still hope—but you gotta hustle!

Why Is the Deadline Important?

Here’s the deal: the IRS has set a deadline for claiming these unclaimed stimulus payments. Once that date passes, poof! It’s gone forever. Seriously, no extensions, no second chances. If you miss it, you’re out of luck. That’s why it’s crucial to understand when this deadline is and what steps you need to take to secure your money.

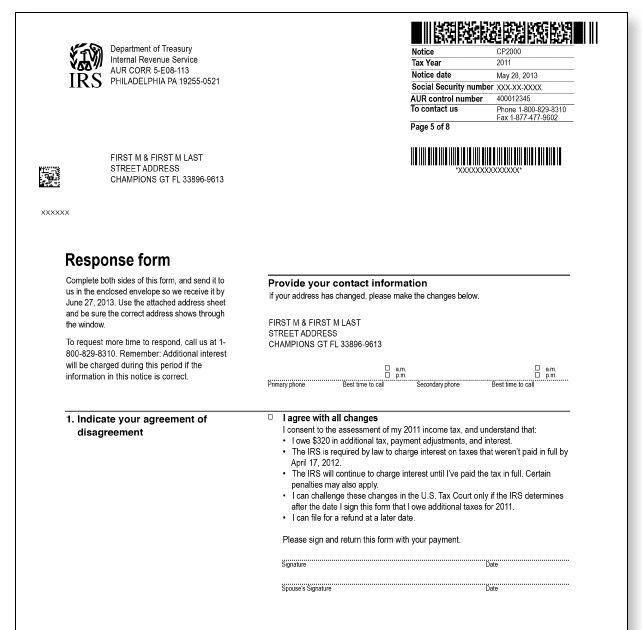

As of now, the IRS is urging people to file their 2021 tax returns ASAP if they haven’t already. Why? Because that’s the only way the IRS will know you’re owed a Recovery Rebate Credit, which is essentially the fancy term for the stimulus check you didn’t get.

And hey, don’t let the word “taxes” scare you. Filing your return doesn’t have to be a headache. There are plenty of free resources available to help you through the process, especially if you’re in a lower income bracket or qualify as a non-filer.

How to Check If You’re Eligible

Alright, so how do you figure out if you’re actually eligible for this $1,400 stimulus check? Lucky for you, it’s not rocket science. Just follow these simple steps:

Read also:For Canada Winning Concacaf Nations League Is The Only Acceptable Result

- Grab your most recent tax return—or whatever financial records you have from 2020 or 2021.

- Check your adjusted gross income (AGI) to see if it falls within the income limits I mentioned earlier.

- Count up your dependents to calculate how much extra money you might be entitled to.

- Finally, confirm whether you actually received a stimulus check back in 2021. If you didn’t, then bingo—you’re probably eligible for a Recovery Rebate Credit.

Still unsure? No worries. The IRS offers an online tool called the “Recovery Rebate Credit Calculator” that can help you determine your eligibility. Just plug in your info, and it’ll spit out an answer in no time.

Steps to Claim Your Stimulus Payment

Okay, so you’ve confirmed that you’re eligible. Now what? Well, my friend, it’s time to roll up your sleeves and get to work. Here’s exactly what you need to do:

Step 1: Gather Your Documents

You’ll need a few key pieces of info to file your tax return, including:

- Your Social Security number (or Individual Taxpayer Identification Number, if applicable).

- Your income information, such as W-2s, 1099s, or any other documents showing how much you earned in 2021.

- Any bank account info you want the IRS to use for direct deposit.

Step 2: File Your 2021 Tax Return

Once you’ve got all your ducks in a row, it’s time to file that tax return. If you’re not a fan of doing taxes yourself, there are tons of free filing options available through the IRS Free File program. Many of these services walk you through the process step-by-step, making it super easy to claim your Recovery Rebate Credit.

And hey, if you’re really stuck, don’t hesitate to reach out to a tax professional or volunteer organization for assistance. Sometimes, having an expert in your corner can make all the difference.

Step 3: Wait for Your Refund

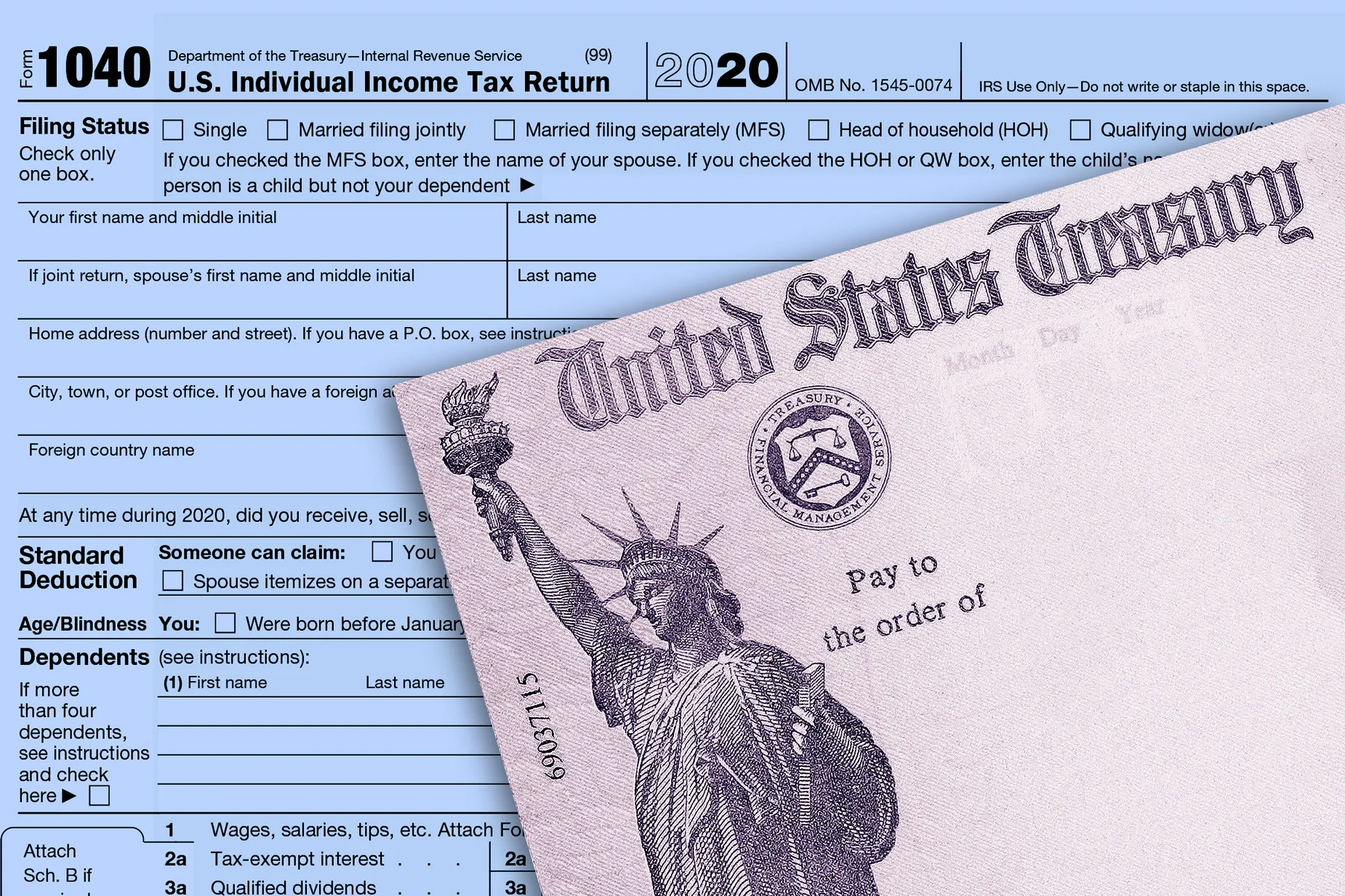

After you’ve filed your return, the next step is to sit tight and wait. Processing times vary depending on how you filed (electronically vs. by mail) and whether you requested direct deposit or a paper check. Generally speaking, though, you should expect to see your refund within a few weeks.

Pro tip: Use the IRS’s “Where’s My Refund?” tool to track the status of your payment. It’s updated daily and gives you a pretty good idea of when to expect your cash.

Common Questions About Stimulus Checks

Let’s address some of the most frequently asked questions about these stimulus payments. Odds are, if you’re wondering about something, someone else probably is too.

Q: Can I Still Get a Stimulus Check Even If I Didn’t File Taxes?

A: Absolutely! As long as you meet the eligibility criteria, you can still claim your stimulus payment. In fact, the IRS has made special provisions for non-filers, allowing them to submit simplified tax returns to claim their Recovery Rebate Credit.

Q: What Happens If I Miss the Deadline?

A: Unfortunately, if you miss the deadline, you won’t be able to claim your stimulus payment retroactively. That’s why it’s so important to act quickly and file your tax return as soon as possible.

Q: Do I Have to Pay Back the Stimulus Check?

A: Nope! Unlike loans or grants, stimulus checks are considered tax credits, meaning you don’t have to repay them. Think of it as a gift from the government to help ease the financial burden of the pandemic.

Statistical Insights on Stimulus Payments

Did you know that over 160 million Americans received stimulus checks during the pandemic? That’s right—millions of people benefited from these payments, using the money to cover everything from rent and groceries to medical bills and unexpected expenses.

In fact, according to a report by the U.S. Census Bureau, nearly 40% of recipients used their stimulus checks to pay off debt, while another 30% put the money toward essential household expenses. Clearly, this financial assistance made a huge impact on the lives of countless families across the country.

But here’s the kicker: despite the widespread distribution of these checks, millions of eligible individuals never received their payments. Whether it was due to missed filings, incorrect information, or other administrative errors, many people simply slipped through the cracks. Which is why campaigns like this one are so vital—raising awareness and helping folks claim what’s rightfully theirs.

How to Avoid Scams and Fraud

As with anything involving money, there are always scammers lurking in the shadows trying to take advantage of unsuspecting victims. So, how can you protect yourself from fraud when claiming your stimulus check?

- Never give out personal information, such as your Social Security number or bank account details, unless you’re absolutely certain the request is legitimate.

- Beware of unsolicited emails, texts, or phone calls claiming to be from the IRS. The agency will never contact you via these methods to demand immediate payment or personal info.

- Stick to official channels, like the IRS website, for all your tax-related needs.

Remember, if something seems too good to be true, it probably is. Trust your gut and err on the side of caution whenever dealing with sensitive financial matters.

Conclusion: Act Now to Secure Your Stimulus Payment

Alright, that’s a wrap, folks. Hopefully, by now you have a clear understanding of what’s at stake and what you need to do to claim your $1,400 stimulus check. Time is of the essence, so don’t delay—get those taxes filed and start enjoying the fruits of your labor.

And hey, while you’re at it, why not share this article with friends and family who might also benefit from this info? After all, spreading the word could make all the difference for someone who’s been struggling to make ends meet. Together, we can ensure that no one gets left behind in this recovery effort.

So, what are you waiting for? Go ahead and take action today. Your wallet—and your peace of mind—will thank you for it!

Table of Contents

- What You Need to Know About the $1,400 Stimulus Check

- Why Is the Deadline Important?

- How to Check If You’re Eligible

- Steps to Claim Your Stimulus Payment

- Step 1: Gather Your Documents

- Step 2: File Your 2021 Tax Return

- Step 3: Wait for Your Refund

- Common Questions About Stimulus Checks

- Statistical Insights on Stimulus Payments

- How to Avoid Scams and Fraud