Hey there, finance enthusiasts! Let me paint a picture for you: imagine a room filled with some of the sharpest minds in the world of economics and finance, all gathered to decide the future of the U.S. economy. This is no ordinary meeting; it's the FOMC meeting, or Federal Open Market Committee meeting, and it’s a big deal. Like, a really big deal. Why? Because these meetings set the tone for monetary policy, interest rates, and more. So, buckle up, because we’re diving deep into what makes these meetings so important and how they impact not just the U.S., but the entire global economy.

Now, you might be thinking, "What exactly happens in an FOMC meeting?" Well, think of it as a high-stakes poker game where the players have all the cards, but instead of chips, they’re dealing with trillions of dollars. These meetings aren’t just about setting interest rates; they’re about shaping the financial landscape. From Wall Street to Main Street, everyone’s watching these meetings closely because the decisions made here can affect everything from your mortgage rate to the stock market.

And here’s the kicker: understanding the FOMC meeting isn’t just for economists or bankers. It’s for anyone who wants to stay ahead in the game of personal finance, investing, or even just keeping up with the news. So, let’s break it down, step by step, and make sense of this financial jargon together. Stick around because this is gonna be a wild ride!

Read also:Uc Riverside Vs Santa Clara Mar 18 2025 Live Score Whos Going To Dominate The Court

What Exactly is the FOMC?

Alright, let’s start with the basics. The Federal Open Market Committee (FOMC) is basically the decision-making body within the Federal Reserve System that determines monetary policy. In simpler terms, it’s the group responsible for deciding how much money should be in circulation, what interest rates should be, and how to keep the economy running smoothly. Think of them as the financial referees, making sure the game doesn’t get out of hand.

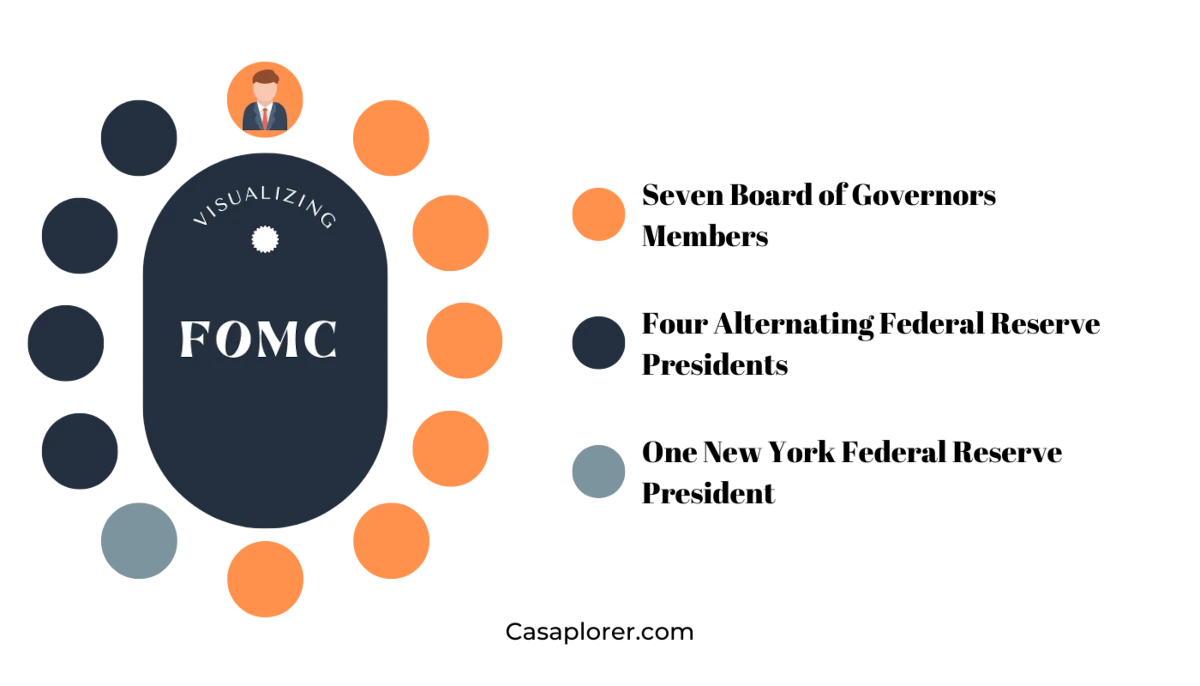

Here’s the fun part: the FOMC isn’t just one person calling the shots. It’s made up of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Federal Reserve Bank presidents. These guys meet eight times a year, and each meeting is a big deal. Why? Because they’re discussing everything from inflation rates to unemployment numbers, and their decisions can send shockwaves through the global market.

For example, if the FOMC decides to raise interest rates, it can lead to higher borrowing costs for businesses and consumers. On the flip side, if they lower interest rates, it can stimulate spending and investment. So, whether you’re saving for a house or planning to invest in stocks, the FOMC’s decisions can directly impact your financial plans.

Who’s Who in the FOMC?

Let’s get to know the players in this financial game. The FOMC is led by the Chair of the Federal Reserve, who’s currently Jerome Powell. But it’s not just about one person; it’s a team effort. Each member brings their own expertise and perspective to the table, making the discussions lively and well-rounded.

Here’s a quick breakdown of the key players:

- Jerome Powell: The Chair of the Federal Reserve, leading the charge.

- Board of Governors: Seven members who provide oversight and guidance.

- Federal Reserve Bank Presidents: Five out of the 12 presidents rotate in and out of voting positions, bringing regional insights to the table.

Each member has their own area of expertise, whether it’s inflation, employment, or international trade. This diversity ensures that all angles are covered when making decisions that affect the economy.

Read also:Trace Adkins The Country Music Legend You Cant Ignore

The Importance of FOMC Meetings

So, why should you care about the FOMC meetings? Well, let me put it this way: if you’ve ever wondered why the stock market goes up or down, or why mortgage rates change, the answer often lies in what happens during these meetings. The FOMC’s decisions can have a ripple effect that touches every aspect of the economy.

For instance, if the FOMC decides to hike interest rates, it can lead to a stronger dollar, which might be great for travelers but tough on exporters. Conversely, if they lower rates, it can boost borrowing and spending, which is great for businesses but might lead to inflation if not managed properly. It’s a delicate balancing act, and the FOMC plays a crucial role in keeping things in check.

And here’s the kicker: the FOMC doesn’t just focus on the U.S. economy. Their decisions can affect global markets too. For example, a rate hike in the U.S. can lead to capital flowing out of emerging markets, affecting their economies. So, whether you’re an investor in New York or a small business owner in Jakarta, the FOMC’s decisions matter.

How FOMC Meetings Impact You

Let’s break it down even further. Here’s how FOMC meetings can directly impact your life:

- Mortgage Rates: If the FOMC raises interest rates, your mortgage payments might go up.

- Savings Accounts: Higher interest rates can mean better returns on your savings.

- Stock Market: FOMC decisions can cause fluctuations in the stock market, affecting your investments.

- Credit Cards: If rates go up, your credit card interest might increase too.

So, whether you’re a homeowner, an investor, or just someone trying to save for the future, the FOMC’s decisions can have a real impact on your financial well-being.

The Mechanics of an FOMC Meeting

Alright, let’s dive into the nitty-gritty of how these meetings actually work. First off, the FOMC meets eight times a year, usually for two days. During these meetings, they discuss everything from economic data to global market trends. But it’s not just about talking; they also vote on key decisions, like whether to raise or lower interest rates.

Here’s how it typically goes down:

- Day 1: The committee reviews economic data, including inflation rates, employment numbers, and GDP growth. They also discuss global market trends and how they might affect the U.S. economy.

- Day 2: The committee deliberates on monetary policy and votes on key decisions. After the meeting, they release a statement summarizing their decisions and providing guidance on future policy moves.

And here’s the cool part: the FOMC’s statements are closely watched by analysts and investors around the world. A single word or phrase can send markets soaring or plummeting. So, if you’re into finance, these statements are gold.

Key Decisions Made During FOMC Meetings

Let’s talk about the big decisions the FOMC makes during these meetings:

- Interest Rates: The most talked-about decision is whether to raise, lower, or keep interest rates the same.

- Quantitative Easing: In times of economic distress, the FOMC might decide to implement quantitative easing, which involves buying government bonds to inject money into the economy.

- Forward Guidance: The FOMC provides guidance on future policy moves, helping markets prepare for changes.

These decisions aren’t made lightly. They’re based on extensive research, data analysis, and careful consideration of the potential impacts. And trust me, the world is watching.

Understanding the Economic Data

Now, let’s talk about the data that drives these decisions. The FOMC relies on a wide range of economic indicators to make informed decisions. Here are some of the key ones:

- Inflation: Measured by the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index.

- Employment: The unemployment rate and job creation numbers are closely monitored.

- GDP Growth: The overall health of the economy is assessed by looking at GDP growth rates.

Each of these indicators provides a piece of the puzzle, helping the FOMC understand the current state of the economy and make decisions accordingly. And here’s the thing: the data can change rapidly, which means the FOMC has to be agile and responsive to new information.

Why Data Matters

Data is the lifeblood of the FOMC. Without accurate and up-to-date information, they wouldn’t be able to make informed decisions. For example, if inflation is rising too quickly, the FOMC might decide to raise interest rates to cool things down. Conversely, if unemployment is high, they might lower rates to stimulate job creation.

And here’s the kicker: the data isn’t just numbers on a page. It represents real people and real economies. So, when the FOMC makes a decision, they’re not just moving numbers around; they’re affecting lives.

The Global Impact of FOMC Decisions

Let’s zoom out for a second and look at the bigger picture. The FOMC’s decisions don’t just affect the U.S. economy; they have a global impact too. For example, a rate hike in the U.S. can lead to capital flowing out of emerging markets, affecting their economies. Conversely, a rate cut can lead to capital flowing into emerging markets, boosting their economies.

Here’s how it works:

- Exchange Rates: A stronger dollar can make U.S. exports more expensive, affecting trade balances.

- Capital Flows: Changes in interest rates can affect where investors choose to put their money.

- Global Markets: FOMC decisions can cause fluctuations in global stock markets, affecting investors worldwide.

So, whether you’re a multinational corporation or a small business owner, the FOMC’s decisions can have a real impact on your operations.

Case Studies: FOMC Decisions in Action

Let’s look at a couple of real-world examples to see how FOMC decisions have played out:

- 2008 Financial Crisis: During the financial crisis, the FOMC implemented quantitative easing to inject liquidity into the market, helping to stabilize the economy.

- 2020 Pandemic: In response to the pandemic, the FOMC lowered interest rates to near zero and implemented massive stimulus measures to support the economy.

These examples show just how powerful the FOMC’s decisions can be. They have the ability to shape the course of the global economy, and that’s no small feat.

Preparing for the Next FOMC Meeting

So, how can you prepare for the next FOMC meeting? Whether you’re an investor, a business owner, or just someone trying to stay informed, there are a few things you can do:

- Stay Informed: Follow financial news and keep an eye on economic indicators.

- Adjust Your Plans: If you’re planning to take out a mortgage or invest in stocks, consider how FOMC decisions might affect your plans.

- Consult Experts: If you’re unsure about how to navigate the financial landscape, consider consulting with a financial advisor.

Remember, the FOMC’s decisions can have a real impact on your financial well-being, so staying informed is key.

Final Thoughts

Alright, that’s a wrap on FOMC meetings. Whether you’re a finance pro or just someone trying to make sense of the financial world, understanding the FOMC is crucial. These meetings aren’t just about numbers and policies; they’re about shaping the future of the global economy. So, keep an eye on the next FOMC meeting, stay informed, and most importantly, stay ahead in the game.

And hey, if you’ve got any questions or thoughts, drop a comment below. Let’s keep the conversation going!

Table of Contents

- What Exactly is the FOMC?

- The Importance of FOMC Meetings

- The Mechanics of an FOMC Meeting

- Understanding the Economic Data

- The Global Impact of FOMC Decisions

- Preparing for the Next FOMC Meeting

- Who’s Who in the F