Ever wonder why the world holds its breath every time the Fed announces interest rates? It's not just some boring financial jargon—it's the heartbeat of the global economy, baby! Fed interest rates are like the DJ at a party; they set the tone for everything. When they crank it up, the vibe changes. When they slow it down, things chill out—or sometimes get real awkward. Stick around, and we’ll break it all down for you in a way that’ll make you feel like a finance wizard by the end of this ride.

Now, let’s be real. Interest rates might sound like something only bankers care about, but they’re super relevant to everyone. Whether you’re trying to buy a house, invest in stocks, or even just save up for that dream vacation, what the Fed decides can have a massive impact on your wallet. And let’s not forget, the ripple effect goes beyond borders, affecting economies worldwide.

So, buckle up, because we’re diving deep into the world of fed interest rates, uncovering what they mean, how they work, and why they’re such a big deal. It’s gonna be an epic ride, trust me!

Read also:Trace Adkins The Country Music Legend You Cant Ignore

What Are Fed Interest Rates Anyway?

Alright, let’s start with the basics. Fed interest rates, also known as the federal funds rate, are essentially the interest rates that banks charge each other for overnight loans. Sounds simple, right? Well, not exactly. These rates are a key tool used by the Federal Reserve (the Fed) to influence the U.S. economy. They’re like the steering wheel that helps guide the ship through rough waters.

When the economy is sluggish, the Fed might lower these rates to encourage borrowing and spending. Think of it as a sale at your favorite store—everyone wants to take advantage of the deals. On the flip side, if the economy’s overheating and inflation’s getting out of control, the Fed might jack up the rates to cool things down. It’s a delicate balancing act, and the stakes are high.

Why Do Fed Interest Rates Matter?

Here’s the thing: Fed interest rates aren’t just some numbers on a screen. They have real-world implications that affect everything from your mortgage payments to the cost of borrowing for businesses. When rates go up, borrowing becomes more expensive, which can slow down economic growth. Conversely, when rates drop, borrowing gets cheaper, giving the economy a boost.

But it’s not just about the U.S. economy. Since the dollar is the world’s reserve currency, what happens in the U.S. has a domino effect globally. For instance, higher interest rates in the U.S. can attract foreign investors, strengthening the dollar and potentially weakening other currencies. It’s a complex web, but understanding it can help you navigate the financial landscape better.

How Do Fed Interest Rates Impact You?

Let’s get personal for a sec. How exactly do these rates affect your day-to-day life? If you’ve got a mortgage, car loan, or credit card debt, you’re already feeling the impact. Higher interest rates mean higher monthly payments, which can strain your budget. On the flip side, if you’re a saver, higher rates can be a good thing because your savings earn more interest.

And let’s not forget about investments. Stock markets tend to react strongly to changes in interest rates. When rates rise, borrowing costs for companies go up, potentially affecting their profits and stock prices. Investors often adjust their portfolios accordingly, which can lead to market volatility.

Read also:Mexican Soccer Team The Passion History And Future Of La Seleccioacuten

Real-Life Examples of Rate Changes

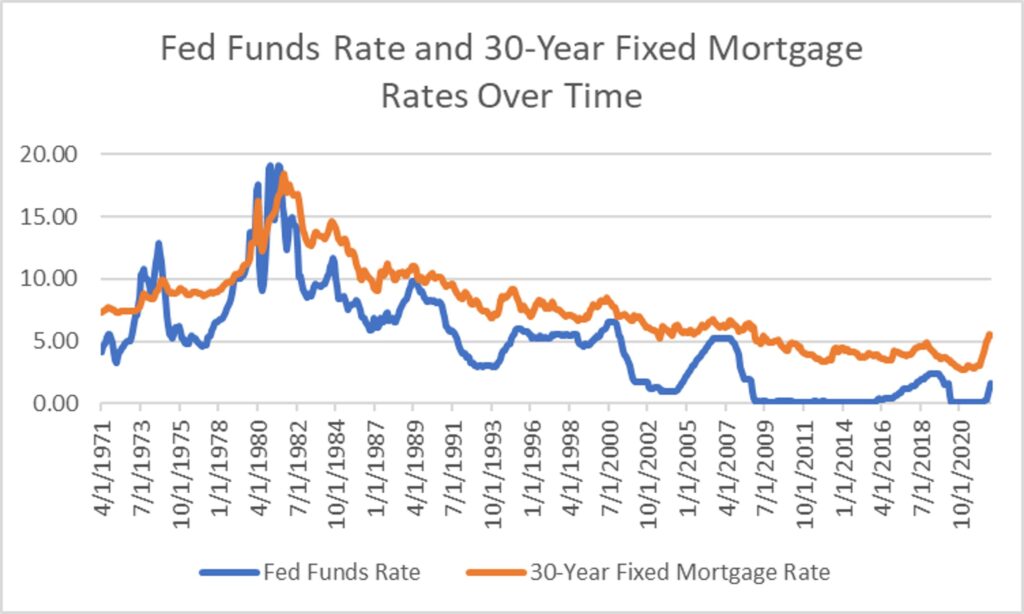

Let’s look at a couple of examples to see how rate changes have played out in real life. Back in 2008, during the financial crisis, the Fed slashed interest rates to near zero to stimulate the economy. This move helped stabilize the markets and kickstart recovery. Fast forward to 2022, when inflation hit record highs, the Fed had to hike rates multiple times to bring it under control. The result? A stronger dollar, but also a slowdown in economic growth.

The Mechanics of Fed Interest Rates

So, how exactly does the Fed set these rates? It’s not like flipping a switch. The Federal Open Market Committee (FOMC) meets several times a year to assess economic conditions and decide on monetary policy. They look at a bunch of factors, including employment data, inflation rates, and GDP growth, before making a decision.

One important tool they use is something called the dot plot. It’s basically a graph that shows where FOMC members think interest rates should be in the future. It’s like a crystal ball for the economy, giving investors and economists a glimpse into the Fed’s thinking.

Who’s Behind the Scenes?

Ever wonder who the big players are in this game? The Fed is led by a Board of Governors, with the Chairman being the most prominent figure. Janet Yellen, Ben Bernanke, and Alan Greenspan are just a few names that have shaped monetary policy over the years. These folks have their fingers on the pulse of the economy, making decisions that affect millions of lives.

Historical Context of Fed Interest Rates

To truly understand the significance of fed interest rates, it’s important to look at their history. Back in the day, interest rates were much higher than they are now. In the early 1980s, the Fed hiked rates to over 20% to combat sky-high inflation. It was a tough pill to swallow, but it worked. Since then, rates have generally trended downward, reflecting changes in the global economic landscape.

But history also shows us that the Fed doesn’t always get it right. The dot-com bubble in the late ‘90s and the housing bubble in the mid-2000s were partly fueled by low interest rates. It’s a reminder that while the Fed has a lot of power, predicting the future is never an exact science.

Lessons Learned from the Past

What can we learn from these historical ups and downs? For one, flexibility is key. The Fed needs to be able to adapt to changing circumstances quickly. Also, communication is crucial. When the Fed surprises markets with unexpected moves, it can lead to chaos. That’s why transparency and clear guidance are so important.

Global Implications of Fed Interest Rates

Let’s zoom out for a sec and look at the bigger picture. The U.S. might be the world’s largest economy, but it doesn’t exist in a vacuum. Changes in fed interest rates can have far-reaching effects on other countries. For instance, when the dollar strengthens due to higher rates, it can make it harder for emerging markets to repay their dollar-denominated debts.

Moreover, global trade is heavily influenced by currency values. A stronger dollar can make U.S. exports more expensive, potentially hurting American businesses. It’s a delicate balancing act that requires coordination between central banks around the world.

How Other Countries React

Other central banks often adjust their own policies in response to Fed moves. For example, if the Fed raises rates, other banks might follow suit to prevent their currencies from depreciating too much. It’s a game of chess where every move has consequences. And just like in chess, one wrong move can lead to disaster.

Future Trends in Fed Interest Rates

So, what’s on the horizon for fed interest rates? With inflation still a concern and the global economy facing uncertainty, the Fed’s decisions will be closely watched. Some experts predict that rates might stay higher for longer to ensure inflation remains under control. Others think the Fed might need to pivot if economic growth slows too much.

Technological advancements and shifts in global trade patterns could also play a role in shaping future policy. As the world becomes more interconnected, the Fed will need to consider a wider range of factors when setting rates.

Preparing for the Future

What can you do to prepare for potential rate changes? If you’ve got debt, it might be wise to lock in fixed rates now before they go up. For investors, diversifying your portfolio can help mitigate risks. And if you’re saving, keep an eye on interest rates to maximize your returns.

Expert Insights on Fed Interest Rates

To get a deeper understanding, we spoke to a few experts in the field. Dr. Emily Carter, an economist at a leading think tank, shared her thoughts: “The Fed’s role is more important than ever in today’s globalized economy. Their decisions have far-reaching implications that affect everyone, not just Wall Street.”

Johnathan Lee, a financial analyst, added: “It’s crucial for individuals to stay informed about fed interest rates. They might seem abstract, but they have a tangible impact on our daily lives.”

What the Experts Agree On

One thing all the experts agree on is that understanding fed interest rates is key to making informed financial decisions. Whether you’re a seasoned investor or just starting out, knowing how these rates work can give you a competitive edge.

Final Thoughts and Call to Action

And there you have it, folks. Fed interest rates might seem complex, but they’re not as daunting as they appear. By understanding how they work and their impact, you can better navigate the financial world. So, what’s next? Why not leave a comment below with your thoughts? Or share this article with a friend who could benefit from the knowledge. And if you’re hungry for more, check out our other articles on finance and economics. Stay curious, stay informed, and most importantly, stay ahead of the game!

Oh, and before you go, here’s a quick recap of what we covered:

- Fed interest rates are a crucial tool used by the Fed to influence the economy.

- They impact everything from mortgage payments to stock market performance.

- Understanding their history and mechanics can help you make better financial decisions.

- Global implications mean that what happens in the U.S. affects economies worldwide.

- Stay informed and prepared for future trends by keeping an eye on expert insights.

Table of Contents

- What Are Fed Interest Rates Anyway?

- How Do Fed Interest Rates Impact You?

- The Mechanics of Fed Interest Rates

- Historical Context of Fed Interest Rates

- Global Implications of Fed Interest Rates

- Future Trends in Fed Interest Rates

- Expert Insights on Fed Interest Rates

- Final Thoughts and Call to Action